Page 48 - Proceeding The 2nd International Seminar of Science and Technology : Accelerating Sustainable Innovation Towards Society 5.0

P. 48

nd

The 2 International Seminar of Science and Technology

“Accelerating Sustainable innovation towards Society 5.0”

ISST 2022 FST UT 2022

Universitas Terbuka

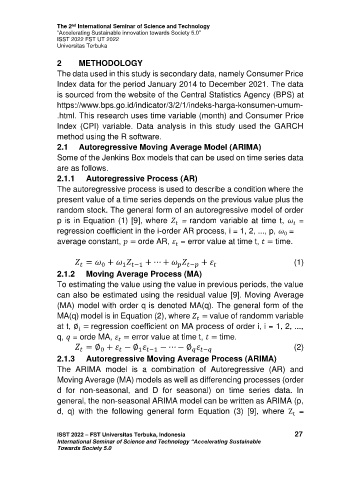

2 METHODOLOGY

The data used in this study is secondary data, namely Consumer Price

Index data for the period January 2014 to December 2021. The data

is sourced from the website of the Central Statistics Agency (BPS) at

https://www.bps.go.id/indicator/3/2/1/indeks-harga-konsumen-umum-

.html. This research uses time variable (month) and Consumer Price

Index (CPI) variable. Data analysis in this study used the GARCH

method using the R software.

2.1 Autoregressive Moving Average Model (ARIMA)

Some of the Jenkins Box models that can be used on time series data

are as follows.

2.1.1 Autoregressive Process (AR)

The autoregressive process is used to describe a condition where the

present value of a time series depends on the previous value plus the

random stock. The general form of an autoregressive model of order

p is in Equation (1) [9], where = random variable at time t, =

regression coefficient in the i-order AR process, i = 1, 2, ..., p, =

0

average constant, = orde AR, = error value at time t, = time.

= + + ⋯ + + (1)

−

1 −1

0

2.1.2 Moving Average Process (MA)

To estimating the value using the value in previous periods, the value

can also be estimated using the residual value [9]. Moving Average

(MA) model with order q is denoted MA(q). The general form of the

MA(q) model is in Equation (2), where = value of randomm variable

at t, ∅ = regression coefficient on MA process of order i, i = 1, 2, ...,

q, = orde MA, = error value at time t, = time.

= ∅ + − ∅ − ⋯ − ∅ (2)

−

1 −1

0

2.1.3 Autoregressive Moving Average Process (ARIMA)

The ARIMA model is a combination of Autoregressive (AR) and

Moving Average (MA) models as well as differencing processes (order

d for non-seasonal, and D for seasonal) on time series data. In

general, the non-seasonal ARIMA model can be written as ARIMA (p,

d, q) with the following general form Equation (3) [9], where Z =

t

ISST 2022 – FST Universitas Terbuka, Indonesia 27

International Seminar of Science and Technology “Accelerating Sustainable

Towards Society 5.0